How To Master Your Finances With Gomyfinance.com Create Budget

Feeling lost when it comes to managing your money? gomyfinance.com create budget is here to save the day. Imagine having a personal finance assistant that works 24/7, helping you stay on top of your financial game without breaking a sweat. Sounds too good to be true? Well, buckle up because we’re diving deep into how this platform can transform your financial life.

Let’s face it, budgeting can feel like trying to solve a Rubik’s cube blindfolded. But what if I told you there’s a smarter way to handle your cash flow? gomyfinance.com create budget is not just another app; it’s a game-changer for anyone serious about taking control of their finances. Whether you’re a young professional trying to save for a dream vacation or a family looking to secure your financial future, this tool has got your back.

In today’s fast-paced world, financial literacy isn’t just an option—it’s a necessity. And with gomyfinance.com create budget, you don’t need a finance degree to get started. This platform simplifies budgeting so much that even someone with zero experience can navigate it like a pro. So, are you ready to take the first step towards financial freedom? Let’s jump in!

- Spiderman Across The Spiderverse Cast Ndash Your Ultimate Guide To The Starstudded Lineup

- Charlies Angels 2 A Sequel That Fans Have Been Waiting For

Before we dive into the nitty-gritty, here’s a quick roadmap to help you navigate this article:

- What is gomyfinance.com Create Budget?

- Benefits of Using gomyfinance.com Create Budget

- How to Get Started with gomyfinance.com Create Budget

- Effective Budgeting Strategies with gomyfinance.com

- Key Features and Tools of gomyfinance.com

- Pro Tips for Maximizing Your Budgeting Experience

- How gomyfinance.com Stacks Up Against Competitors

- Is gomyfinance.com Safe and Secure?

- Joining the gomyfinance.com Community

- Wrapping It Up: Why gomyfinance.com Create Budget is a Must-Try

What is gomyfinance.com Create Budget?

Alright, let’s break it down. gomyfinance.com create budget is an all-in-one budgeting platform designed to make managing your money as easy as ordering pizza online. No more spreadsheets, no more guessing where your money went at the end of the month. This platform takes care of everything for you, from tracking expenses to setting savings goals.

But what makes gomyfinance.com stand out? For starters, it’s super user-friendly. Whether you’re a tech whiz or a complete newbie, you’ll find the interface intuitive and straightforward. Plus, it integrates seamlessly with your bank accounts, credit cards, and other financial tools, giving you a holistic view of your financial health.

- Kate Evans Scam The Untold Story You Need To Know About

- Spiraling Spirit Age A Deep Dive Into The Mystical Phenomenon

Think of it like having a personal finance coach in your pocket. It doesn’t just tell you where your money is going; it helps you plan for the future, too. From emergency funds to retirement savings, gomyfinance.com create budget has got all your bases covered.

Why You Need a Budgeting Tool

Let’s be real, budgeting isn’t exactly the most exciting thing in the world. But here’s the thing—without a budget, you’re flying blind when it comes to your finances. gomyfinance.com create budget eliminates the guesswork, helping you make informed decisions about where your money should go.

- Keeps you accountable for your spending habits.

- Helps you identify areas where you can cut back.

- Encourages smarter financial planning for the long term.

And hey, who doesn’t want to be in control of their financial destiny, right?

Benefits of Using gomyfinance.com Create Budget

Now that we’ve established what gomyfinance.com create budget is, let’s talk about why you should care. Here are some of the top benefits of using this platform:

1. Simplifies Complex Finances

No one likes dealing with complicated financial jargon. gomyfinance.com create budget simplifies everything, breaking down your finances into easy-to-understand categories. Whether you’re tracking daily expenses or planning for a big purchase, this tool makes it effortless.

2. Real-Time Updates

Gone are the days of waiting for your bank statements to arrive in the mail. With gomyfinance.com create budget, you get real-time updates on your accounts, so you always know where you stand financially.

3. Customizable Features

Not everyone’s financial situation is the same, which is why gomyfinance.com offers customizable features to fit your unique needs. From setting personalized goals to creating custom categories for your expenses, the platform adapts to you, not the other way around.

How to Get Started with gomyfinance.com Create Budget

Ready to take the plunge? Getting started with gomyfinance.com create budget is a breeze. Here’s a step-by-step guide to help you get up and running:

- Sign up for a free account on the gomyfinance.com website.

- Connect your bank accounts, credit cards, and other financial tools.

- Set up your budget categories and goals.

- Start tracking your expenses and watch your savings grow!

It’s as simple as that. And don’t worry, the platform offers plenty of tutorials and support to help you along the way.

Effective Budgeting Strategies with gomyfinance.com

Having the right tools is only half the battle. To truly master your finances, you need to implement effective budgeting strategies. Here are a few tips to help you make the most of gomyfinance.com create budget:

1. The 50/30/20 Rule

This classic budgeting method divides your income into three categories: 50% for needs, 30% for wants, and 20% for savings. gomyfinance.com create budget makes it easy to track these percentages and adjust as needed.

2. Zero-Based Budgeting

With zero-based budgeting, every dollar you earn has a purpose. gomyfinance.com create budget helps you allocate your income down to the last cent, ensuring you’re maximizing your financial resources.

3. Envelope System

If you’re a fan of the old-school envelope system, gomyfinance.com create budget lets you digitize the process. Assign specific amounts to different categories and stick to your limits—it’s that simple.

Key Features and Tools of gomyfinance.com

What sets gomyfinance.com create budget apart from the competition? Let’s take a closer look at some of its standout features:

1. Automated Expense Tracking

Forget about manually entering every transaction—gomyfinance.com does the heavy lifting for you. The platform automatically categorizes your expenses, saving you time and effort.

2. Goal Setting

Whether you’re saving for a down payment on a house or planning a dream vacation, gomyfinance.com create budget helps you set achievable goals and track your progress.

3. Alerts and Notifications

Stay on top of your finances with customizable alerts and notifications. Get reminders when bills are due, when you’re nearing your spending limits, or when you’ve reached a savings milestone.

Pro Tips for Maximizing Your Budgeting Experience

Want to take your budgeting game to the next level? Here are a few pro tips to help you get the most out of gomyfinance.com create budget:

- Review your budget regularly to ensure you’re staying on track.

- Take advantage of the platform’s reporting features to analyze your spending patterns.

- Don’t be afraid to tweak your budget as your financial situation changes.

Remember, budgeting is a journey, not a destination. Stay flexible and adapt as needed to achieve your financial goals.

How gomyfinance.com Stacks Up Against Competitors

With so many budgeting apps on the market, you might be wondering how gomyfinance.com create budget compares. Here’s a quick rundown:

1. User Interface

gomyfinance.com boasts a sleek, modern design that’s both functional and visually appealing. Other apps can feel cluttered or overwhelming, but gomyfinance.com keeps things simple and streamlined.

2. Integration

When it comes to integrating with third-party services, gomyfinance.com is at the top of its game. It works seamlessly with a wide range of financial tools, giving you a comprehensive view of your finances.

3. Customer Support

Need help? gomyfinance.com offers excellent customer support, with resources available 24/7 to assist you with any questions or issues.

Is gomyfinance.com Safe and Secure?

Security is a top priority for gomyfinance.com create budget. The platform uses state-of-the-art encryption and security protocols to protect your sensitive financial information. Plus, it’s compliant with industry standards, so you can rest easy knowing your data is in good hands.

Still skeptical? gomyfinance.com also offers two-factor authentication and other security features to give you an extra layer of protection.

Joining the gomyfinance.com Community

One of the coolest things about gomyfinance.com create budget is the vibrant community of users who are all working towards the same goal—financial freedom. Whether you’re looking for tips, advice, or just a little motivation, the gomyfinance.com community has got your back.

Join forums, participate in challenges, and connect with like-minded individuals who are on the same financial journey as you. Together, you can achieve greatness!

Wrapping It Up: Why gomyfinance.com Create Budget is a Must-Try

So, there you have it—everything you need to know about gomyfinance.com create budget. From simplifying complex finances to offering customizable features and top-notch security, this platform has everything you need to take control of your financial future.

Don’t let another month go by without a solid budget in place. Try gomyfinance.com create budget today and see the difference it can make in your life. And remember, the sooner you start, the sooner you’ll reach your financial goals.

Got questions or feedback? Drop a comment below and let’s chat. Or better yet, share this article with a friend who could benefit from gomyfinance.com create budget. Together, we can build a financially savvy community—one budget at a time!

- Uscg Aux Logo A Closer Look At The Symbol Of Maritime Service Excellence

- What Is Dere Definition The Ultimate Guide To Understanding Dere In Everyday Context

Weekly Budget Planner Template, Weekly Budget Sheets, Weekly Bill

Budget Visuals FREE Infographic Maker

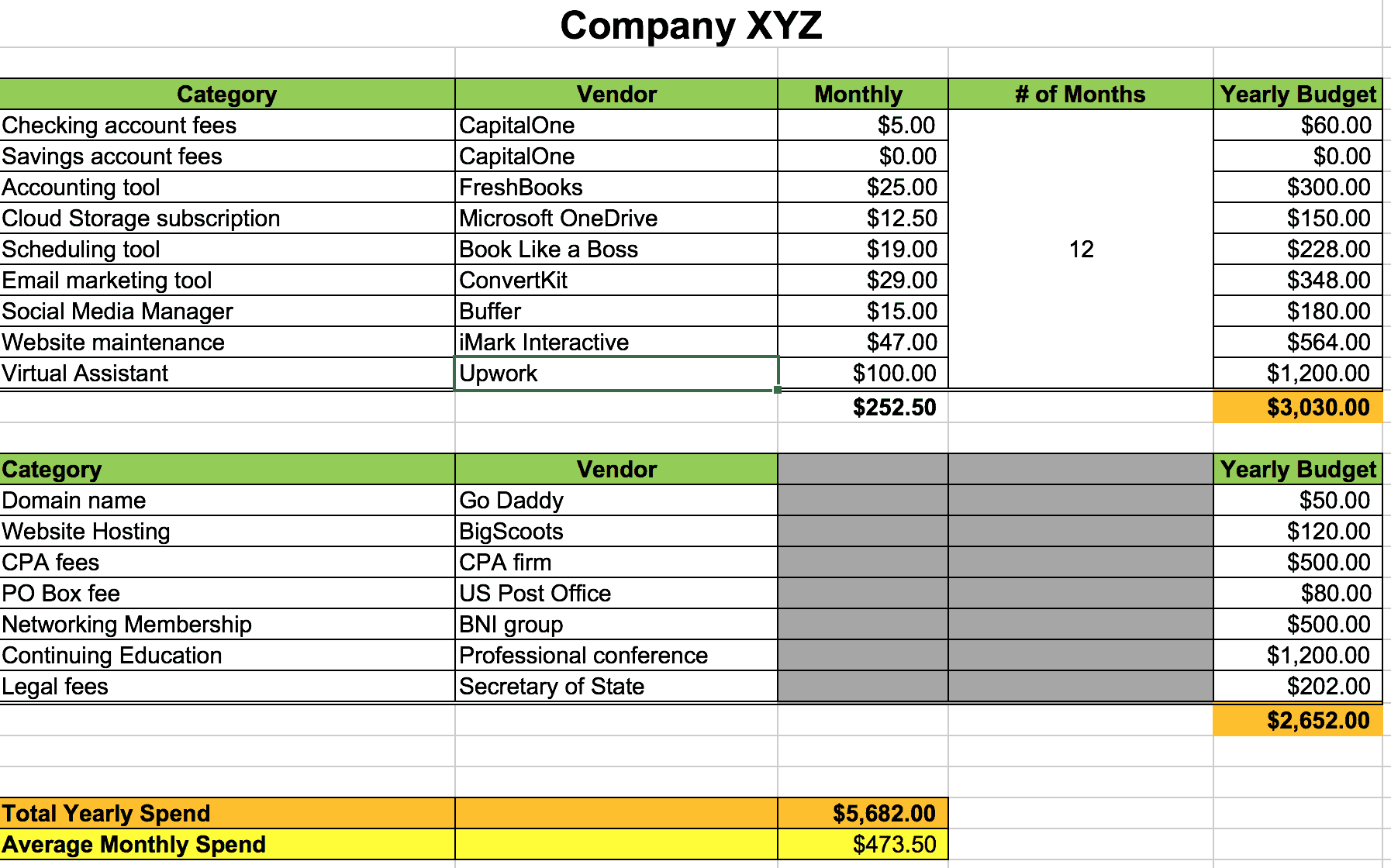

How to Create a Business Budget SMI Financial Coaching